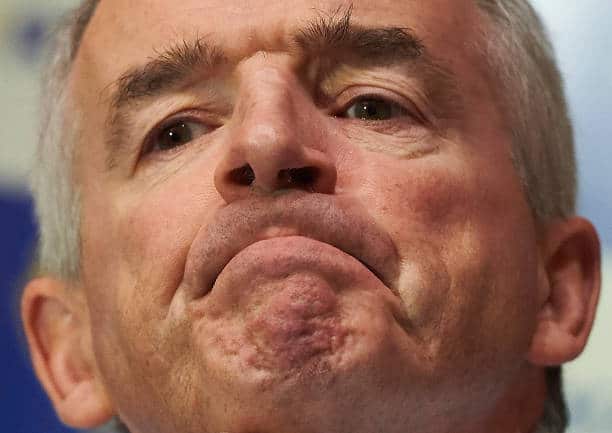

Ryanair boss Michael O’Leary has said average air fares in the run-up to Christmas will likely remain lower than 12 months ago, despite softer flight prices damaging the airline’s profits of late.

Ryanair’s newly-published first half financial figures – covering the six months to the end of September – show an 18%, year-on-year, drop in after-tax profit to €1.79bn. Revenue was up 1% at €8.69bn; but the slowdown was hit by lower fares during the period.

Average air fares fell 10% in the first half of Ryanair’s current financial year (which runs to the end of March), and were down 7% in the second quarter, alone.

However, the lower fares also drove passenger numbers, with Ryanair reporting a 9% year-on-year increase to 115.3 million passengers.

“We remain cautious on Q3’s [Ryanair’s financial third quarter from October to the end of December] average fare outlook, expecting them to be modestly lower than Q3 prior year,” Mr O’Leary said on the back of Ryanair’s latest financial results.

“The move of half Easter into PYQ4 and out of Q1, consumer spending pressure – driven by higher-for-longer interest rates and inflation reduction measures – and a drop in OTA [online travel agent] bookings ahead of summer 2024 necessitated more price stimulation than originally expected as Ryanair maintained its ‘load active/yield passive’ pricing policy. Many customers are switching to Ryanair for our lower air fares. As a result, we are capturing record share gains across most markets,” Mr O’Leary said.

“We continue to target between 198 million and 200 million passengers in FY25 [which would represent yearly growth of 8%], subject to no worsening of current Boeing delivery delays,“ he added.