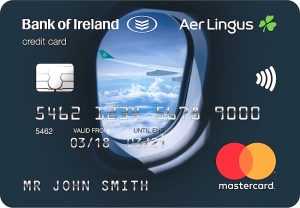

Bank of Ireland has teamed up with Aer Lingus to introduce the new co-branded Aer Credit Card that combines a regular credit card with a range of travel rewards for customers (over 18s only).

Each year, customers who sign up to the card will receive: two free return fares to Europe (1), two fast track and priority boarding passes (2), two lounge passes (3), and worldwide multi-trip family travel Insurance, including winter sports (4). Customers can collect one Avios for every €1 spent on Aer Lingus products and services and one Avios for every €4 spent on all other transactions (5).

The rewards package from which cardholders can benefit is said to be worth in excess of €200* on receipt of the card, and increases to a value in excess of €400 when reward flights become available, notwithstanding the additional benefits that Avios enables. Aer Credit Card will cost €7.99 per month plus Government stamp duty of €30 per annum with standard annual interest rate of 16.12% variable and Annual Percentage Rate (APR) of 26.6% variable for purchases**.

Christine Hamill, Head of Retail Cards, Bank of Ireland said: “We are delighted to partner with Aer Lingus to create this unique proposition for our customers. We are constantly looking at ways to reward our customers. Year on year, credit cards are coming out on top as the number one payment choice for holiday purchases. Aer Credit Card will enhance customers’ travel experience with lounge access, fast passes, travel insurance and free fares to reward them for their loyalty. In addition the extended Avios earned can be used to save money on flights, hotels and car hire.”

Susanne Carberry, Director of Network Revenue and Loyalty, Aer Lingus, said: “The launch of Aer Credit Card is an exciting next step for AerClub, which recently welcomed its one millionth member, and we are delighted to partner with Bank of Ireland. We launched AerClub two years ago with the ambition of creating an offering that would have widespread appeal and everyday relevance. Aer Credit Card is a strong addition to this portfolio as it offers a credit card product together with attractive travel rewards and equally allows cardholders to earn Avios with every transaction.”

Bank of Ireland also allows customers to spread larger credit card payments over €500 at a low rate of 6.9% APR. The payment plan option is an ideal way to budget for a holiday as it offers an excellent rate with payments spread over 12 months***.

Aer Credit Card complements the offering of AerClub, Aer Lingus’s loyalty programme that offers its members the opportunity to collect Avios ‘in the air’ each time they fly, ‘on the ground’ with partners such as SuperValu and Kildare Village, and ‘online’ via the AerClub eStore, which is home to hundreds of top name brands including retail, hotels and car hire, across Ireland, Europe and North America.

Avios is the reward currency of AerClub. By collecting Avios, members can turn their flights and shopping into reward flights and more with Aer Lingus and AerClub airline partners.

(1) You pay taxes, fees and charges. Available when you spend €5,000 or more within a Reward Year on your Aer Credit Card, except for excluded transactions. Free return fares are for any European Aer Lingus ticketed and operated flights to/from Dublin, Cork, Shannon or Belfast. Travel restrictions apply. A minimum of two seats per flight will be available, except for restricted periods. Seat availability on the Aer Lingus website or through a booking agent does not guarantee a free return fare.

(2) On Aer Lingus operated flights out of Ireland at selected airports every reward year.

(3) To access airport lounges at Dublin, Cork, Shannon and Belfast every reward year.

(4) Acceptance criteria, terms and conditions apply. Bank of Ireland Travel Insurance is underwritten by AIG Europe Ltd.

(5) Avios are issued and redeemed in accordance with Avios terms and conditions.

* Cardholders Benefit

Fast Track & Priority Boarding Passes: €5.95 per pass x2

Airport Lounge Passes: €30 per access x2

Worldwide Multi-trip Travel insurance: €157.79 per policy per annum

Total: €229.69pa / €19.14pm

** Representative example of Aer Credit Card purchase at standard interest rate of 16.12% variable. Typical Annual Percentage Rate (APR) of 26.6% variable, including annual Government stamp duty of €30 and an annual charge of €95.88 (made up of 12 monthly charges of €7.99). Assuming purchase of €3,000 repaid in equal instalments over a 12-month period. The total amount repayable by the customer is €3,387.90, which includes initial purchase of €3,000 and a total cost of credit of €387.90.

*** Representative example of Credit Card Instalment plan purchase at standard interest rate of 6.9% APR variable. Assuming purchase of €580 repaid in equal instalments over a 12-month period. The total cost of credit is €21.02 and monthly repayments of €50.09.