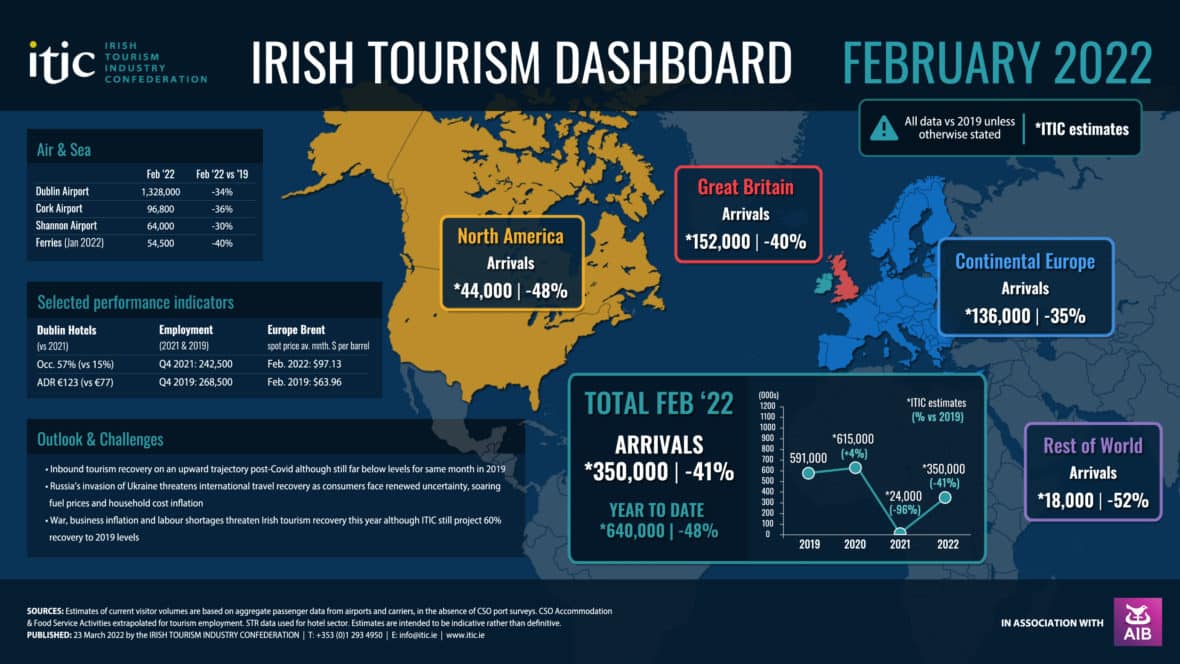

The Irish Tourism Industry Confederation (ITIC) has today issued its first tourism dashboard since the pandemic which will track the industry’s recovery on a monthly basis going forward.

February data shows total arrivals were down 41% compared to the same month in 2019. Hotel occupancy stood at 57% while average Brent oil prices – a key determinant of carrier fares – were €93 per barrel, 52% higher than the same month pre-pandemic.

The Tourism Dashboard is published in association with AIB and compares each month to the same month in 2019, the last normal year for the Irish tourism industry. Using carrier and port data ITIC is able to extrapolate inbound visitor numbers by market-based on past performance.

Eoghan O’Mara Walsh, CEO of ITIC, said “Comparing tourism monthly data to 2019 we feel is the best comparison and will help track recovery. Pre-pandemic tourism was the country’s largest indigenous industry and biggest regional employer and it is vital that the sector returns to growth”.

In February Continental Europe recovered most strongly down 35% on 2019 while the key North American market was down 48%. O’Mara Walsh pointed out that the tourism season traditionally kicks off around St Patrick’s Festival and that tracking market performance on a monthly basis would act as a key guide to the industry’s state of recovery.

“Overall, in 2022 we are hoping for a 60% recovery in inbound tourism numbers compared to 2019 which would be no mean feat considering the mauling that the industry has faced in the last 2 years” said O’Mara Walsh who warned that the war in Ukraine, inflation and labour shortages could put a handbrake on the sector’s recovery.

Mary Mackin, Hospitality Sector Strategist for AIB, said “Government supports have been crucial in supporting the sector remain open over the last two years and despite the challenges the data shows, AIB is optimistic that tourism will rebound in 2022. The tourism and hospitality industry is fundamentally important to the Irish economy – employment, regional economic balance, and exchequer returns are dependent on a thriving sector.”