Craig Donnelly of Accident & General is running daily webinars that explain in detail the full terms of its Covid Cover, which is available on all their policies. You can arrange a webinar by directly accessing Craigs Calendar here and simply book yourself in. Be aware though, April is already filling up fast….

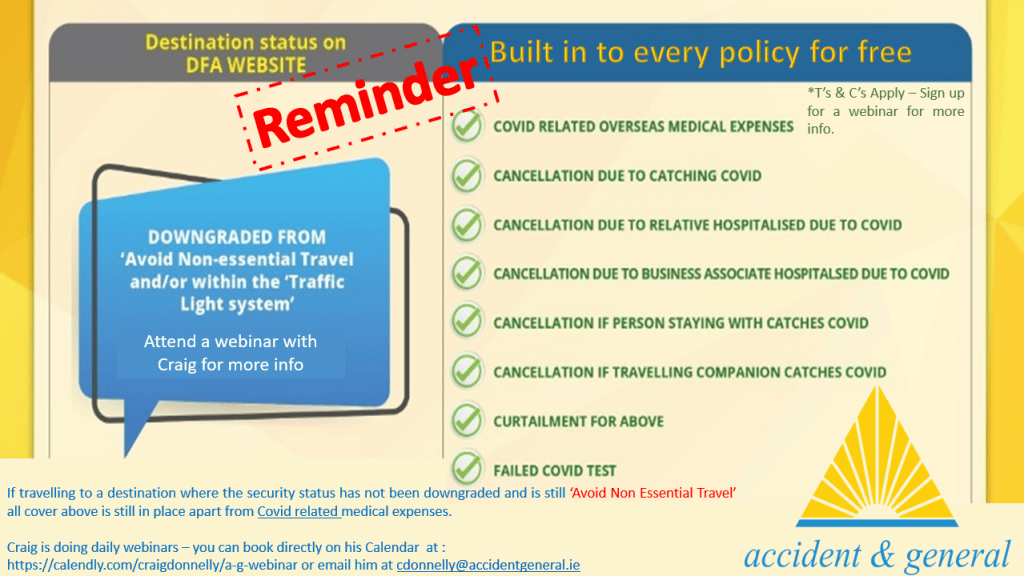

“As Accident and General are Trade Only,” Craig says, “they are fully reliant on the trade emerging from the Covid crisis with the proper tools to provide a high level of confidence to their clients. As such, there is a wide range of cancellation cover relating to Covid built into their policies.”

“As Accident and General are Trade Only,” Craig says, “they are fully reliant on the trade emerging from the Covid crisis with the proper tools to provide a high level of confidence to their clients. As such, there is a wide range of cancellation cover relating to Covid built into their policies.”

“Booking a holiday has always been a large financial investment. And this is only exacerbated by all things COVID related. We aim to provide market leading cancellation cover should the insured person, their travelling companion or someone with whom they are going to visit falls ill with Covid prior to departure.”

There is cover if they are diagnosed with Covid 14 days prior to departure, increased to 28 days if they are hospitalised.

“Should a client fail a Covid test prior to departure within this timescale, they will be covered for cancellation costs. For business travellers, cancellation cover also applies should a close business associate be hospitalised with a Covid diagnosis at the time of the trip – essential for the post covid business traveller. Should an immediate relative be admitted to hospital at time of the trip, we will also cover cancellation costs.”

“In relation to overseas medical expenses, should a client travel to a destination where the security status relating to Covid has been downgraded from ‘Avoid all but essential travel’, then Covid related medical expenses and curtailment costs are included in the policy. If the client travels to a destination which remains at ‘Avoid all but essential travel’, we still cover medical expenses for injury or illness as normal, but not in relation to Covid.”

“A&G intend to offer market leading coverage to support the travel industry and it is the industry that knows best what will be required to provide consumer confidence – if additional cover is required, please do contact me and we can discuss.”